ECOP Webinar Series

“SSS Services and Assistance in the Time of a Public Health Emergency”

3 April 2020, 2:00PM – 4:00PM

In addition to the Employers Confederation of the Philippines’ (ECOP) initiative to help employers and employees alike in the midst of the current coronavirus pandemic, ECOP conducted its 3rd webinar, this time with the Social Security System (SSS) entitled “SSS Services and Assistance in the Time of a Public Health Emergency” last 3 April hosted by Mr. Jose Roland Moya, Director-General of ECOP, and Mr. Jhomer Gonzales as the resource speaker from the SSS.

It is very important to note that during this time of crisis, the SSS has put in place specific programs/policies such as the Calamity Loan Assistance Program (CLAP), Loan Restructuring Program, moratorium period, Contribution Penalty Condonation Program, payment deadlines, unemployment benefits and other contingencies that may arise under the jurisdiction of the Social Security System.

For the information and guidance of qualified members.

Flash Survey Results:

- To provide an understanding regarding the response of employers to the Enhanced Community Quarantine, a survey through the use of Mentimeter was conducted for the following:

-

- What is the profile of our participants in this webinar? (Out of 698 respondents: 4% Employer/Business Owners; 85% Human Resource Personnel; 10% Currently employed)

- Are you an SSS member? (Out of 730 respondents: 99% Yes; 1% No)

- If you are a member, what type of membership do you have? (Out of 752 respondents: 9% Compulsory coverage as employer; 90% Compulsory coverage as employee; 0% Compulsory coverage as self-employed; 0% Compulsory coverage as OFW; 0% Voluntary coverage as separated member; 0% Voluntary coverage as non-working spouse of SSS member; 0% Voluntary coverage as Filipino permanent migrant)

- What is the current status of your company? (Out of 784 respondents: 15% Total shutdown/stop operations; 41% slowdown of operations/on skeletal workforce; 3% business as usual/normal operations; 41% everyone on WFH arrangement)

- Have you ever applied for a loan at SSS? (Out of 807 respondents: 27% Yes, in the past; 47% Yes, I have an on-going loan; 10% No, but I am planning to; 17% No)

- What type of SSS loan have you applied for in the past? (Out of 681 respondents: 99% Salary loan; 1% Business loan; 1% Housing loan)

-

Resource Persons:

Mr. Jhomer C. Gonzales

Mr. Jhomer C. Gonzales

Corporate Executive Officer II – Member Education Department

Social Security System (SSS)

Highlights of the Presentation:

On the Calamity Loan Assistance Program (CLAP) of SSS

- Member-borrowers who are residents of the entire Philippines affected by the COVID-19 situation may be eligible for loan application if he satisfies the requirements:

-

-

- Registered in the SSS website (My.SSS) to facilitate the online filing of CLAP application;

- Must have at least 36 monthly contributions (does not need to be continuous), 6 of which should be posted within the last 12 months prior to the month of filing of application;

- Have no outstanding Loan Restructuring Program (LRP) or CLAP

- If employed, the employers must be updated in the payment of SS contributions and loan remittances as of Feb 2020 (i.e. with posted payments for the applicable month of January 2020 and previous months); and

- Must not have been granted any final benefit, i.e. total permanent disability or retirement

-

-

- Those who have LRP are not qualified since they need to be in good standing prior to availing CLAP.

- The interest rate shall be 10% per annum commencing on the 4th month, computed on a diminishing principal balance, to be amortized over a period of 24 months. No advanced interest shall be charged on this loan.

- Moreover, the service fee of 1% of the loan amount is waived.

- The loan is payable in 27 months inclusive of the 3-month moratorium period. The loan amortization shall start on the 4th month following the date of the approval of the loan.

- On the concern of members regarding the lack of internet access at the moment, the target availing period for CLAP will be up to 3 months starting from the date of the issuance of the corresponding SS Circular.

On the 3-Month Moratorium

- The purpose of the loan moratorium is to lessen the burden of SSS member-borrowers who are experiencing loss of income as a result of the COVID-19 situation. The moratorium period shall be for the applicable months of February to April 2020. This would mean that the loan payment term will be extended by a maximum of 3 months.

- The moratorium on short-term loans will be automatic for all eligible loans. Qualified members shall be electronically identified based on the eligibility qualifications and will be automatically covered by the moratorium. They need not file a request or application to SSS.

- To be eligible, members should be able to fulfill the following requirements:

-

-

- Salary/ calamity/ emergency loan should have been granted from 1 Jan. 2018 to 16 March 2020

- Must have at least 36 monthly contributions, 6 of which should be posted within the last 12 months prior to the filing of the application

- Restructured loan under LRP/Educational Assistance Loan that is currently amortizing (loans that are matured or expired prior to 16 March 2020 and loans that were granted after 16 March 2020 are excluded in this program)

-

-

On other important matters

- Employers need not wait for SSS to issue a memorandum before starting to deduct again from the salaries of their employees once the lockdown is lifted. It should be automatic on the part of the employer to deduct on the salaries of its employees after the 3-month moratorium.

- As for the payment of premium contributions for the applicable months of January, February, and March, or First Quarter of 2020, these may be paid until 1 June 2020 without penalties.

- On the other hand, the payment deadlines for self-employed/voluntary members and non-working spouses for applicable months and/or quarter/s after March 2020 shall follow.

- As for all regular and household employers, contributions for the applicable months of February, March, and April may be paid until 1 June 2020.

- For employers with approved installment proposals under the Contribution Penalty Condonation Program (SSS Circular No. 2019-004), their post-dated checks due in February, March, April, and May 2020 shall be deposited on 1 June 2020.

- Payment deadlines for the applicable months after April 2020 shall follow the regular deadlines set under SSS Circular No. 2019-012 (August 2019)

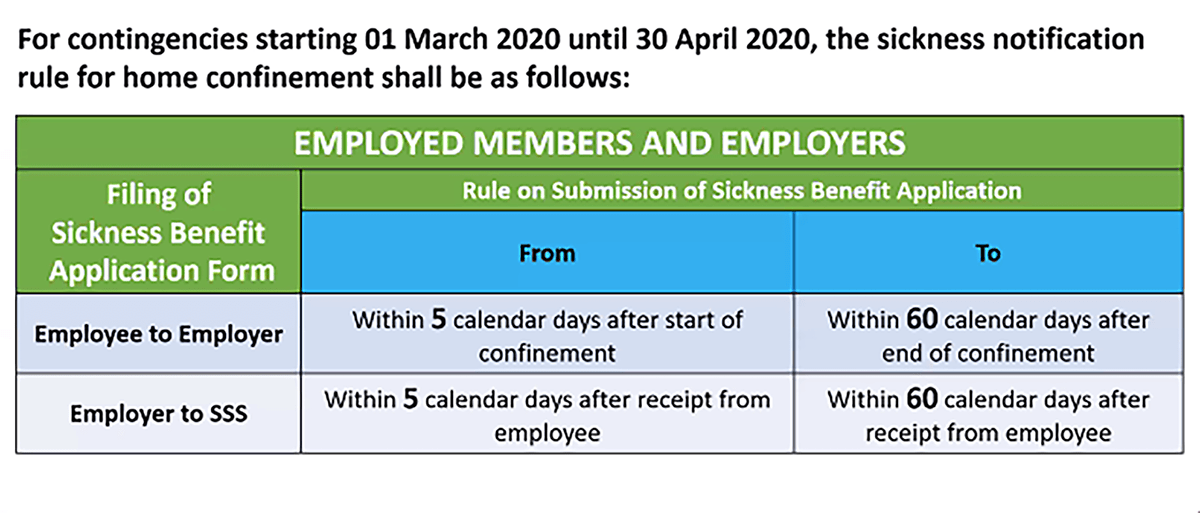

- On matters regarding the temporary extension of filing period for sick notifications and sickness benefit claims:

-

-

- For contingencies starting 1 March 2020 until 30 April 2020 the sickness notification rule for home confinement shall be as follows:

-

-

- As for the unemployment benefit, it was clarified that it as a cash benefit granted to covered employees, including kasambahays and Overseas Filipino Workers, who are involuntarily separated from employment

- To be qualified, members should be able to fulfill all the requirements:

-

-

- Should not be over 60 years of age at the time of involuntary separation, except:

-

-

- In case of an underground or surface mine workers, not over 50

- Racehorse jockeys, not over 55

-

-

- Has paid at least 36 monthly contributions, 12 months of which should be in the 18-month period immediately preceding the month of involuntary separation

- Has no settled unemployment benefit within the last 3 years prior to the date of involuntary separation

- Has been involuntarily separated provided that the reason for involuntary separation was due to any of, but not limited to:

-

- Any of the following authorized causes for termination of employees under Articles 298 (283) and 299 (284) of Presidential Decree No. 442 (Labor Code of the Philippines)

-

-

- Installation of labor-saving devices;

- Redundancy;

- Retrenchment or downsizing;

- Closure or cessation of operation; or

- disease/illness of the employee whose continued employment is prohibited by law or is prejudicial to his or his co-employees’ health

-

-

- Any of the following just causes stated under Article 300 (285) of PD 442, as amended, for which an employee may put an end to the employment relationship without notice to employers:

-

-

- Serious insult by the employer or his representative on the honor and person of the employee;

- Inhuman and unbearable treatment accorded the employee by the employer or his representative;

- Commission of a crime or offense by the employer or his representative against the person of the employee or any of the immediate members of his/her family; and

- Other causes analogous to any of the foregoing

-

-

- Economic downturn

- Natural or human-induced calamities/disasters

- Other analogous cases as may be determined by the Department of Labor and Employment (DOLE) and SSS

- Any of the following authorized causes for termination of employees under Articles 298 (283) and 299 (284) of Presidential Decree No. 442 (Labor Code of the Philippines)

-

- Should not be over 60 years of age at the time of involuntary separation, except:

-

-

- However, an employee shall not be qualified to receive unemployment benefit if he/she has been involuntarily separated from employment due to just cause under Article 297 (282) of P.D. No. 442, as amended.

- The amount of benefit is a one-time payment and shall be computed as follows:

Unemployment Benefit = Average Monthly Salary Credit (AMSC)

x 50% x 2 months

- Where AMSC shall be the higher of the following:

-

-

- The result obtained by dividing the sum of the last sixty (60) monthly salary credits immediately preceding the semester of contingency by sixty (60); or

- The result obtained by dividing the sum of all the monthly salary credits prior to the semester of contingency by the number of monthly contributions paid in the same period.

-

-

- As for the prescriptive period of filing, claims for unemployment benefit shall be filed within one (1) year from the date of involuntary separation.

- However, there are limitations that shall be considered:

-

-

- A covered employee who is involuntarily separated can only claim unemployment benefit once every three (3) years starting from the date of involuntary separation;

- In case of concurrence of two (2) or more compensable contingencies within the same compensable period, only the highest benefit shall be paid;

- For the following cases, the settled unemployment benefit shall be deducted, either in partial or full, from the future benefit/s of the member:

-

-

- Overlapping benefits;

- When the involuntary separated employee files a case/complaint against his/her employer and the resolution thereof showed:

-

- That the reason for termination was due to just cause/s under Article 297 (282) of P.D. No. 442, as amended; or

- That the case/complaint resulted in reinstatement of the involuntarily separated employee with payment of backwages

-

- When the filing, processing or payment involves misrepresentation, fraud, or false claims; and

- When the employee is rehired or re-employed within the compensable period

-

-

- Members who are in this situation are encouraged to claim sickness benefit first before the unemployment benefit, therefore giving a contingency period for the loan benefit and to avoid overlapping.

- For the payment of unemployment benefit, it shall be credited to the member’s SSS Unified Multipurpose ID (UMID) card enrolled as ATM or Union Bank of the Philippines (UBP) Quick Card Account; or upon the implementation of the PESONet, payment of unemployment benefit shall be thru the banks under PESONet

-

-

- SSS temporarily suspended the monthly confirmation of pensioners. Pensioners will receive their pensions through their bank accounts starting 23 March 2020.

Question and Answer Portion:

1. Can employees with existing salary loan still apply for calamity loan?

- If they have both salary and calamity loan, they are not qualified. A member cannot have two (2) calamity loans at the same time.

2. What if a member does not have an online account, can he still avail for calamity loan?

- No, he cannot avail calamity loan during this situation.

3. What if a member does not have a UMID ID?

- He has the option to receive it through cheque.

4. Since it is lockdown within NCR, how could SSS help employees receive the cheque for SSS loan which was already approved before the lockdown? How can we get the cheque from the post office?

- SSS is on skeletal workforce making the production of cheques continuous. Based on our last meeting, we were informed that the IATF has already released a resolution regarding this matter wherein PhilPost is back on skeletal workforce operation. SSS has already sent a mail to PhilPost hoping that they can include SSS cheques in their priority mails.

- Members also have the option to get the cheque directly from PhilPost, however there could be some challenges.

5. How many months will it take for the SSS Sickness Notification to be approved by SSS?

- If this case is during this COVID-19 period, get the contact number of servicing branch and coordinate directly with them. In times like this, it should not be prolonged. Processing should only take a maximum of 2 weeks.

6. If a member is a PUM/PUI, is he allowed to file for sick leave benefit?

- Yes, as long as he fulfills the qualifying condition that he has at least 3 contributions prior to ECQ. He needs supporting medical documents to prove that he is sick alongside with home confinement of at least 4 days.

7. Is it possible that the employer will be the one to apply for calamity loan of its employees?

- Pag-IBIG is exploring that arrangement, considering if it would be possible. But as of now, application can only be done individually.

8. If the employee will be terminated before the start date of her maternity leave due to redundancy, is the employer required to advance the full maternity benefit to the employee? If not, what are the requirements we need to provide to the employee if she will process her own maternity benefit with SSS?

- If employee is to be terminated during EML, employer has to pay the benefit in full. After the 30-day period that employee has to fulfill after the approval of her resignation, this will serve as the basis of full pay. On the other hand, benefit to be received from SSS is still good for 105 days (SSS maternity + differential)

9. Regarding the moratorium, is it one-time payment on June?

- Yes, one-time payment

10. The employer already deducted and remitted the loan deduction of employees for February. Does the employer need to refund this amount even if the amount was already paid and reported to SSS?

- If it has already been reported to SSS, since there is a moratorium, amount remitted will be charged to member. If not remitted yet, please refund the amount to your employees.

11. We have already paid for contributions and/or loan payments of our employees, but SSS has not posted it yet. We cannot avail loan due to this, what can we do?

- As much as possible, please pay directly to SSS to avoid unwanted circumstances. If paid through the bank, the bank has a schedule that they follow making the process take longer due to their floating period.

12. Our company is still in operation despite ECQ, do we need to deduct contributions from the salary of our employees?

- As long as employees get salaries, they should pay for contributions. This will be better so that a member does not have unpaid contributions for certain months. But with the current situation of the Philippines, we should be considerate enough not to deduct from the salaries of employees. After moratorium, employer may deduct contributions for the months that employees were not able to pay..

13. Our company is in reduced workdays and salary due to ECQ, do we need to deduct contributions from the salary of our employees?

- The contribution for that certain month that the company is in a reduced work arrangement. Contribution of employees is also reduced in proportion to the amount of salary that they receive

14. Our company stopped operations due to ECQ, do we need to deduct contributions from the salary of our employees?

- No.

15. The February Loan payments have already been deducted from employees’ salary and is ready for payment last March 20, however ECQ has been declared. Currently, our company stopped operations. Do we need to pay it to SSS or can we refund it to employees in line with SSS Loan Moratorium?

- As a form of assistance to your employees, please refund it to them for the mean time.

16. How come the payment of some employees’ loans has not yet been posted yet online?

- There are 3 reasons as to why loan payments remain unposted: (a) erroneous loan date; (b) erroneous loan number; or (c) erroneous loan type

17. Can employers, especially of MSMEs, take-out loan from SSS to release to their employees as 13th month pay?

- Currently, the only loan available for employers is the business loan. SSS is still in discussion on how they could provide further assistance to member-employers.

Click here to watch the webinar

ECOP Webinar on SSS Services and Assistance in the Time of a Public Health Emergency

ECOP Webinar on SSS Services and Assistance in the Time of a Public Health EmergencyJoin us and comment your questions down below!

Posted by Employers Confederation of the Philippines on Thursday, 2 April 2020